The year 2025 will see the ocean carrier world move from a setup of three mega alliances to a system of four big players.

These will consist of one alliance that continues unchanged, two reshaped alliances, and one big standalone carrier.

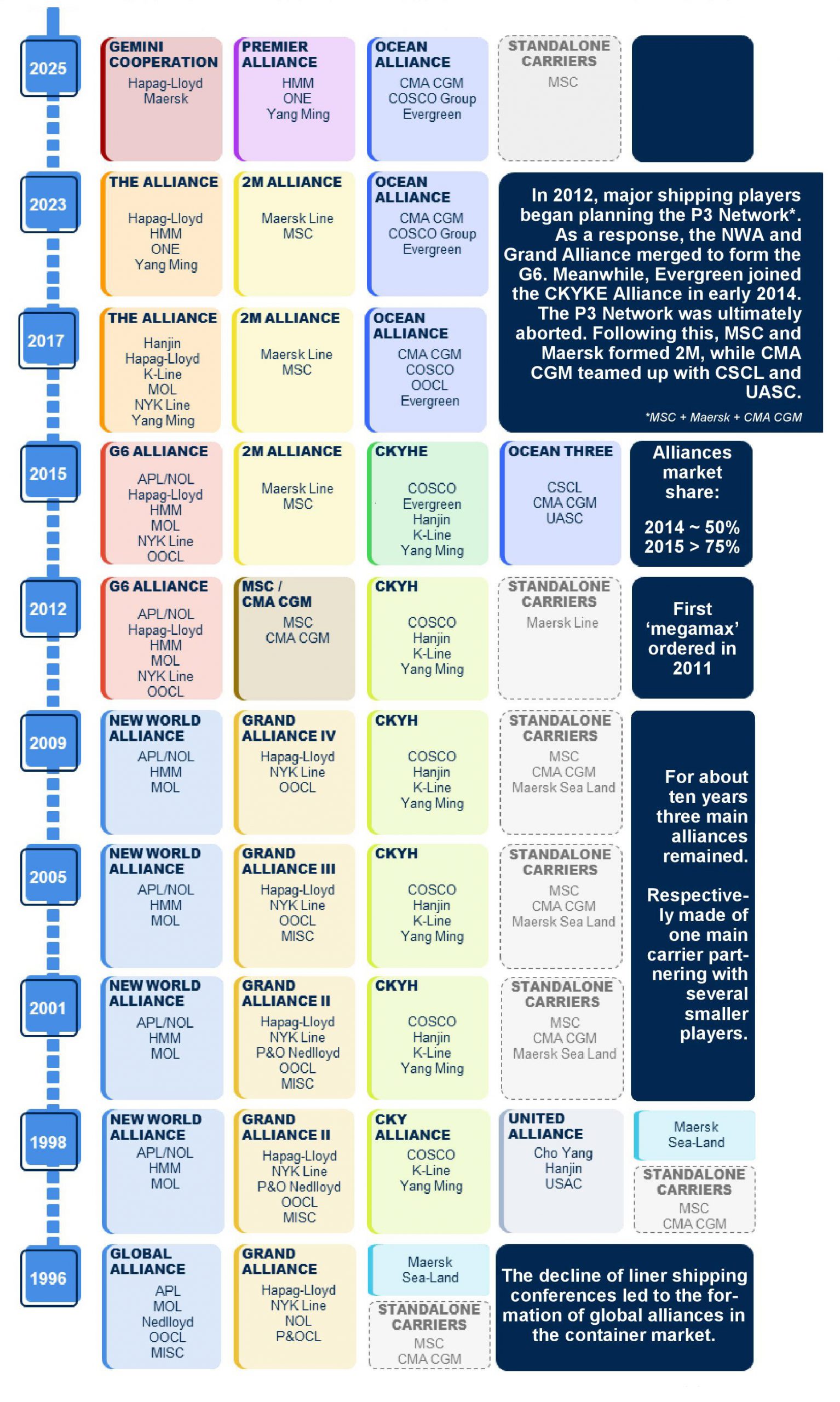

In this edition of the Novastar, we will look at the history of carrier alliances, and illutrate how the new setup of 2025 will change market dynamics in container shipping.

Big changes in container shipping alliances in 2025

How will changes in container shipping alliances in 2025 affect the global supply chain? Get the latest updates on Premier Alliance, Gemini Cooperation and the strategies of major container lines.

Timing is of the essence in the shipping industry. As international container lines prepare to launch their restructured alliances and vessel-sharing agreements in February, a series of global events could put pressure on carefully crafted business plans.

Timing is of the essence in the shipping industry. As international container lines prepare to launch their restructured alliances and vessel-sharing agreements in February, a series of global events could put pressure on carefully crafted business plans.

Big changes in shipping alliances

This restructuring revolves around two notable groups of carriers:

– Premier Alliance, consisting of ONE, Yang Ming and HMM, is the new version of THE Alliance after Hapag-Lloyd left to partner with Maersk.

– Gemini Cooperation, comprising Maersk and Hapag-Lloyd, replaces the previous 2M vessel sharing agreement between Maersk and MSC.

– Premier Alliance: New alliance with ONE, Yang Ming and HMM

ONE (Ocean Network Express) was formed in 2016 by three Japanese shipping lines: K-Line, MOL and NYK, headquartered in Singapore. The alliance focuses on the main East-West trade routes and operates more than 240 vessels with a total capacity of 1.9 million TEU, providing services to 120 countries.

Premier Alliance also owns stakes in many important ports such as:

– North America: TraPac (Port of Oakland, Los Angeles), Yusen Terminals (Los Angeles).

– North Europe: Rotterdam World Gateway (Netherlands).

– Southeast Asia: Magenta Singapore Terminal.

ONE is expected to launch three Asia-Northwest Pacific and five Asia-US East Coast services from February. However, the alliance is still awaiting approval from the US Federal Maritime Commission (FMC), delaying its launch.

– Gemini Cooperation: Maersk and Hapag-Lloyd aim for greater reliability

Gemini Cooperation is a partnership between Maersk (Denmark) and Hapag-Lloyd (Germany) after they terminated their 2M alliance with MSC. Gemini aims to achieve 90% schedule reliability, far exceeding the industry average of 50% since the pandemic began.

Gemini will operate on an airline-like hub-and-spoke model, with 29 mainline and inter-regional feeder services, connecting:

– Asia – US West Coast and East Coast.

– Transatlantic routes.

Meanwhile, MSC – the world’s largest shipping line with 887 ships (6.4 million TEUs, more than 20% of the global market share) – will continue to operate independently. This could lead to lower freight rates due to direct competition between MSC and Gemini on key shipping routes.

Capacity allocation and new ship orders

Shipping alliances currently control more than 80% of global container capacity. New orders could change the balance between alliances in the market.

MSC is the leader in new orders, with 130 ships (2 million TEU, more than a third of current capacity). Meanwhile, Maersk has 50 ships under construction (723,000 TEU, equivalent to 16% of current capacity).

In addition, the Ocean Alliance (CMA CGM, Evergreen, Cosco Shipping and OOCL) has extended its cooperation until 2032. The number of ships in this alliance is as follows:

– CMA CGM (France) has 662 vessels (3.9 million TEU).

– Cosco Shipping (China) has 512 vessels (3.3 million TEU).

– Evergreen (Taiwan, China) has 224 vessels (1.8 million TEU).

Cosco Shipping also has 52 new vessels under construction (881,000 TEU, accounting for 26% of current capacity).

The impact of the geopolitical situation on maritime transport

– The Red Sea crisis and its impact on the supply chain

The Red Sea – an important route connecting Asia, the Mediterranean, Europe and the US East Coast – has become a hot spot after the Houthi armed group attacked commercial ships in late 2023. Most shipping lines have diverted via the Cape of Good Hope (South Africa), extending the journey by up to 14 days.

Surprisingly, this could be a huge boon for the shipping industry in 2024, as supply tightens and freight rates surge.

However, the situation is changing with:

– A ceasefire between Israel and Hamas.

– Internal unrest in Iran – a country supporting the Houthis.

– The possibility of restoring shipping routes via the Suez Canal, which could reduce freight rates by up to 70%.

However, Maersk still warns that security risks remain high, and Gemini will continue to avoid the Red Sea in the initial stages of implementation.

– Trans-Pacific market trends

In 2024, US consumer demand has pushed up cargo volumes from Asia, but:

– US-China trade tensions have caused shipping lines to consider their supply chains.

– New tariff policies could change cargo flows, affecting shipping lines’ strategies.

In addition, MSC and Zim have announced a new alliance on the trans-Pacific trade, connecting Asia to the US East Coast and Gulf of Mexico.

From February, MSC and Zim will partner with the Premier Alliance on services between Asia and Europe. MSC will charter slots on a total of nine weekly services.

Conclusion

2025 will mark a significant shift in the container shipping industry, as shipping alliances adjust their strategies to increase stability and competitiveness. Import-export businesses and logistics companies need to closely monitor changes in the Premier Alliance, Gemini Cooperation and Ocean Alliance, as well as the impact of the geopolitical situation to effectively adjust their logistics plans.

“Novastar clearly prioritizes safety and timeliness for OOG items. From documentation to customs clearance, they’ve got it all covered.”